Its insurance items are readily available in 43 states in the U (cheaper auto insurance).S., Canada, Ireland, and the United Kingdom, and can only be bought through an independent representative. $1,325 Travelers has a slightly higher yearly premium rate for full coverage than Erie Insurance and USAA, however it's still low compared to the remainder of the industry.

It has common discounts that you see with other insurance companies, but a few stand out. Travelers provides a discount for merely owning or renting a hybrid or electric automobile. Its multi-policy discounts lets you save as much as 10%, easily making it a budget friendly one-stop-shop for automobile, home, and life insurance coverage.

Auto-Owners Founded over 100 years earlier, Auto-Owners is a Michigan-based mutual insurance coverage company that uses auto, home, and life insurance. It uses insurance coverage in 26 states to nearly 3 million policyholders.

The business claims you might save as much as 20%, and even more when discount rates are combined. The discounts that Auto-Owners uses for policyholders vary from discounts for trainees and safety functions to discounts for paying your premium on time and completely. It has the greatest ranking in claims fulfillment, according to J.D (car insurance).

There are some discount rates that all of them provide, like bundling or commitment discounts, but there are some that may be distinct to a specific business. So when you're shopping, you desire to make certain you're being proactive and inquiring about all the discounts you get approved for. "Discount rates are substantial, however customers have to ask about them," says Adams.

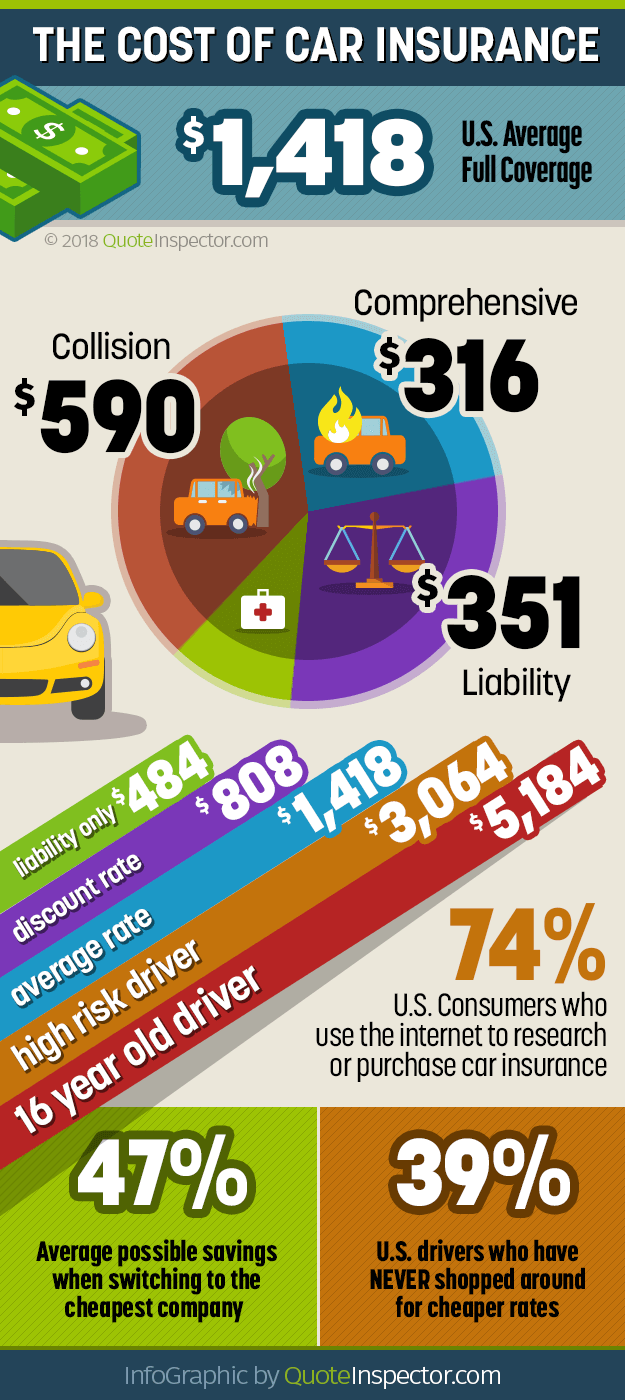

3. Know When to Cut Coverage, Having enough vehicle coverage is very important, however there can be a fine line between insufficient and too much. You must never select less protection simply for the sake of less expensive insurance. Often, it makes sense to drop specific types of protection, like accident and thorough insurance, if your automobile is older and has a low market value.

The Ultimate Guide To Best Cheap Car Insurance For 2021 - The Ascent By Motley Fool

4. Develop Your Credit, Your credit history can play a role in your automobile insurance coverage premiums, depending upon where you live. Some states, like California, Hawaii, Michigan, and Massachusetts, do not enable insurance coverage business to take credit ratings into consideration when setting rates. Remember that insurer likewise use lots of other factors to come up with your rates, not just your credit rating.

Keep a Clean Driving Record Insurance companies prefer to insure safe chauffeurs who do not have a lengthy history of car mishaps or tickets, since they're less likely to file a claim. If your threat for mishaps is low, your rates are more likely to remain low, too - automobile.

One of the very best methods you can conserve on car insurance is by asking your insurer about discount rates (insurance). Numerous vehicle insurance companies use discount rates for automobile safety features or bundling two or more kinds of insurance. Keeping a tidy driving record likewise works to your benefit given that insurers will see you as less of a threat on the roadway.

Insurers factor that the less quantity of time you invest driving, the less likely it is that you'll get into an accident and submit a claim. car. What is the least expensive kind of cars and truck insurance? The minimum coverage needed in your state is the least expensive type of automobile insurance you can get.

Some states require additional protection on top of liability insurance, like uninsured and underinsured motorist coverage or accident protection (PIP). Check your state's website to see the minimum car insurance coverage you're needed to buy. Automobile insurance is not something you want to cut corners on. Specialists recommend getting extra coverage, like thorough and crash, together with liability insurance coverage to guarantee you and your car are safeguarded. affordable auto insurance.

Looking for the most inexpensive secondhand cars and truck to insure? As it turns out, there might not be one single finest choice for all drivers.

Guests are less most likely to be seriously injured after a crash, which indicates lower medical costs. The total crash security score of an automobile will also influence yearly premiums. 2 vehicles may have the exact same safety features, but one of them may have a more secure construction in general. Anti-theft functions can lower the likelihood that your car is stolen and increase the probability that your automobile is recuperated if it is stolen.

Getting The The Cheapest Car Insurance Companies (March 2022) To Work

The more pricey the car, the greater the expense of insurance. Add-on functions such as luxury devices increase the value of the lorry and also make it more pricey to repair or change if taken. Cars and truck insurance coverage rates are greater for cars that have all the bells and whistles. Sports vehicles, high-end luxury designs, and electric cars are more pricey cars and trucks to insure, as they have more distinct parts and cost more to repair.

In basic, a cars and truck that is more expensive to fix will be more pricey to guarantee (low cost auto). Vehicles that utilize basic parts are more affordable to insure, whereas cars that utilize especially old, rare, and hard-to-find elements will cost more to guarantee. In basic, when trying to find the most inexpensive secondhand vehicle to insure, try to find automobiles around 5 to 10 model years old that are basic, dependable models without additional devices.

The least expensive alternative is to get your state's minimum bodily injury and property damage liability coverage. If you secure a loan to buy a pre-owned automobile, you will most likely be needed to have collision and thorough coverage depending upon the worth of the loan and age of the automobile.

If you pay 10 percent of your car's worth for comprehensive and accident protection, it may not deserve it. As an example, let's say you pay $1,000 for cars and truck insurance coverage and $700 of that is for comprehensive and collision protection. If your vehicle deserves $5,000, you're paying more than 10 percent of its worth for thorough and accident.

Of course, you'll need to cover damage to your cars and truck in mishaps you cause. Make sure you can take on this threat before dropping complete protection. Where To Start: Designs With Low Premium Rates While there may not be one model that is always the cheapest used automobile to insure, there are several models that meet much of the criteria mentioned above and are good vehicles to try to find when beginning your search.

Before you buy a used lorry, you may likewise think about having the car examined. Any reliable car dealership will enable you to do this. Be sure to consider maintenance expenses when choosing a used automobile. Even if one vehicle has a cheaper regular monthly insurance premium, it might cost you more down the roadway if it frequently requires upkeep.

Tips For Decreasing Car Insurance Premiums In addition to selecting the best vehicle, there are other ways that drivers can reduce their auto insurance coverage premiums. The very best way to find the most affordable price available to you is to look around and compare alternatives from multiple automobile insurance service providers (car). If you already have another kind of insurance, such as homeowners insurance, think about insuring your automobile with the very same company.

The Only Guide for Cheap Car Insurance - Affordable Auto Insurance - Liberty Mutual

Consider looking for insurers that offer usage-based coverage alternatives. If you are a safe motorist and do not typically drive late at night or on weekends, you may have the ability to save huge this way. cars. Several suppliers have mobile apps that track your driving practices to reduce premiums. Another way to decrease your premiums is to increase your deductible.

Our Recommendations For Utilized Cars And Truck Insurance Once it comes time to purchase insurance for your utilized car, it might not necessarily be the very best idea to opt for the lowest-priced alternative. Be sure that you stabilize expense with dependability and quality claims servicing. Two providers that we suggest for motorists looking for low-cost, top quality vehicle insurance coverage are Geico and USAA.

4 billion in premiums. There is a reason Geico is so popular: it supplies low insurance costs for top-level coverage.

The app tracks distracted driving, tough braking, and driving times to offer policy reductions. However, it is only offered in choose states. We ranked Geico 4. 6 out of 5. 0 stars and called it the very best Total company since of its high levels of customer fulfillment, complete protection alternatives, and strong market credibility.

Methodology In an effort to provide accurate and objective details to consumers, our specialist review team collects information from lots of car insurance companies to develop rankings of the very best insurance companies. Companies get a score in each of the following categories, as well as a total weighted rating out of 5.

home > guides > Insurance coverage > What Is The Most Inexpensive Cars And Truck Insurance in Florida for 2022?

To discover the very best low-cost cars and truck insurance choices it helps to comprehend how automobile protection works. A vehicle insurance policy consists of six standard types of coverage: Liability Protection: If you cause a wreck, this part of your automobile policy pays to repair the damage you triggered both home damage and bodily injury to another person (affordable auto insurance).

Some Known Questions About Dairyland® Auto - Cheap Car Insurance.

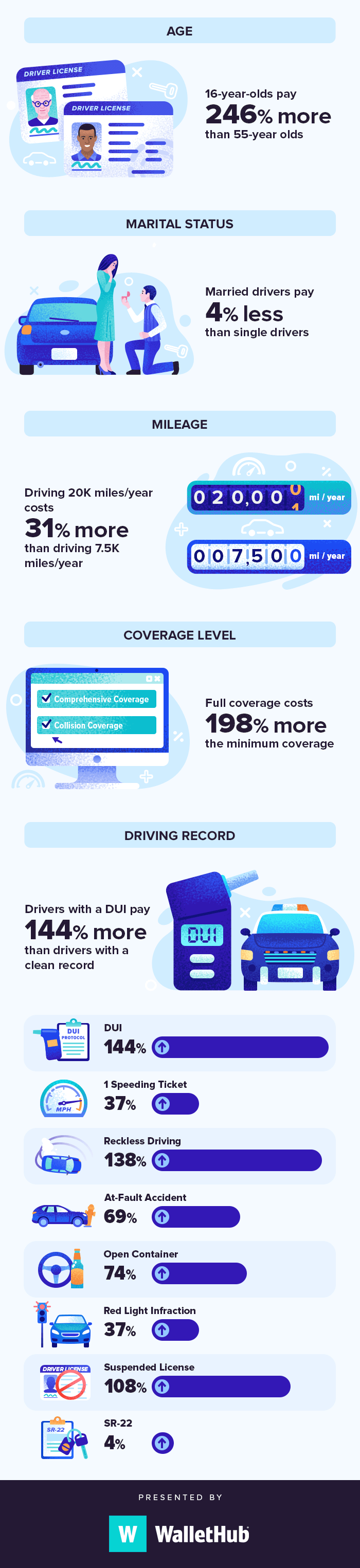

These cover the majority of the scenarios you might get in as a driver and car owner. trucks. Along with your driving record, these elements affect the expense of your coverage: Credit report There is a connection between lower credit report and higher circumstances of claims. Age Stats reveal that the youngest and earliest chauffeurs are associated with more wrecks than other motorists.

Telematics Insurers collect actual information about your driving practices to determine your danger of having a wreck. Car Make and Design Some automobiles cost more to insure than others because they have higher repair expenses or tend to cause more damage in accidents - prices. Automobile Age Because more recent automobiles would cost more to change, policies for more recent cars tend to cost more.

Finest Inexpensive Cars And Truck Insurance Coverage FAQs Who has the least expensive automobile insurance coverage? Based on our analysis, Geico is the insurance business using the most inexpensive rates. Do cars and truck insurance rates differ from state to state?

[money-faqs-item concern="How does my driving record impact my vehicle insurance rate?"] Accidents cost insurance companies cash. car insurance. Somebody with a clean driving record is statistically less likely to have a wreck and can get lower premiums. For for how long do unfavorable marks remain on my driving record? In many states, after 3 to 4 years, the results of the negative marks on your driving record will disappear.

To find the very best low-cost car insurance coverage alternatives it helps to comprehend how automobile coverage works. A car insurance coverage includes six standard kinds of protection: Liability Coverage: If you cause a wreck, this part of your car policy pays to repair the damage you caused both home damage and physical injury to someone else - car.

These cover many of the circumstances you might get in as a motorist and auto owner. In addition to your driving record, these factors impact the cost of your protection: Credit rating There is a connection between lower credit history and higher instances of claims. Age Data reveal that the youngest and oldest chauffeurs are involved in more wrecks than other motorists.

Telematics Insurers gather real data about your driving habits to measure your danger of having a wreck. Vehicle Make and Design Some cars and trucks cost more to insure than others because they have greater repair work expenses or tend to cause more damage in crashes. Cars and truck Age Given that newer cars and trucks would cost more to change, policies for newer cars tend to cost more.

Best Cheap Car Insurance Companies Of April 2022 Can Be Fun For Everyone

Finest Cheap Vehicle Insurance Frequently Asked Questions Who has the most inexpensive cars and truck insurance? Based on our analysis, Geico is the insurance coverage company using the most inexpensive rates. Do car insurance coverage rates vary from state to state?

Accidents cost insurance coverage companies cash. Someone with a clean driving record is statistically less likely to have a wreck and can get lower premiums. In most states, after 3 to four years, the results of the negative marks on your driving record will go away - prices.